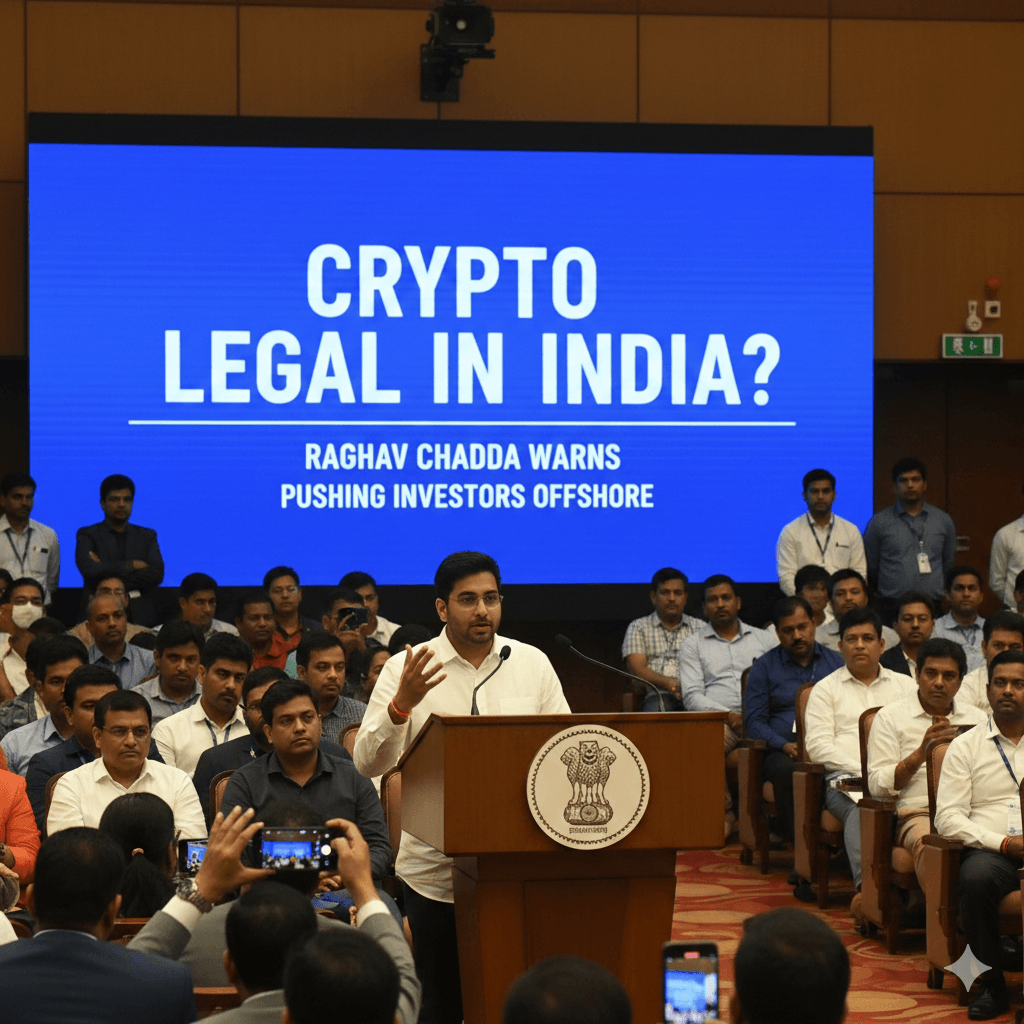

The debate over cryptocurrency legalisation in India is gaining momentum after Raghav Chadha urged the government to legalise cryptocurrencies and stablecoins instead of pushing Indian investment offshore.

In this news item, you will understand what Raghav Chadha said about cryptocurrency in India. You will also understand why the need to legalise crypto and stablecoins is surfacing.

Raghav Chadha has asked the government to enact clear laws on cryptocurrencies rather than compelling Indian investors to take their investments abroad. He said that such ambiguity and high tax laws were forcing individuals and startups to invest in other countries, causing a loss of capital, jobs, and growth opportunities for the country.

The issue also spotlights the government’s current stand on cryptocurrencies and stablecoins. It is clear that though the buying and selling of cryptocurrency is not illegal, it is not officially authorized.

Similarly, stablecoins, though not illegal, are used with caution due to certain monetary control fears.

The issue is important partly because investment outside its shores undermines India’s digital economy, its crypto start-ups, and its stake in new forms of financial technologies.

Unclear regulations pose the biggest risk for Indian investors. It leads to a disincentive for innovation for startups, and for the entire economy, it leads to capital outflow.

What is Cryptocurrency?

- Cryptocurrency refers to a digital or virtual currency with cryptography as its security measure. Cryptocurrency is based on blockchain technology, which uses a decentralised digital ledger that is maintained by nodes connected across a computer network.

- Unlike traditional money, cryptocurrencies are neither issued nor controlled by a central bank or government.

Key features:

- Decentralised (no central authority)

- Secure & transparent (blockchain-based)

- Peer-to-peer transactions

- Limited Supply (for many Cryptocurrencies such as Bitcoin) Examples: BTC, ETH, XRP, Stablecoins like USDT.

History of Cryptocurrency

1️⃣ Early Ideas

- Concepts of digital cash were explored by cryptographers.

- Projects such as DigiCash, developed by David Chaum, attempted secure payments, which didn’t succeed due to a lack of adoption.

2️⃣ Birth of Bitcoin

- In 2008, an individual or group who or which remains unknown wrote a paper called:

- “Bitcoin: A Peer-to-Peer Electronic Cash System.”

- In January 2009, Bitcoin was born, with the Genesis Block mined.

- This was the beginning of the era of cryptocurrency.

3️⃣ Expansion of Cryptos

- New cryptocurrencies (altcoins) emerged:

- Litecoin – Faster Transactions

- Ripple – for cross-border payments

- Crypto began to attract interest within tech communities.

4️⃣ Smart Contracts Era

- Ethereum was founded in 2015 by Vitalik Buterin.

- It introduced the concept of smart contracts, which enabled decentralised applications.

- This gave rise to DeFi, NFTs, and Web3 later on.

5️⃣ Global Adoption & Regulation Debate

- 2017 witnessed a boom in cryptos; even the price of Bitcoin touched 20

- Governments started discussing the regulation, taxation, and associated risks.

- Stablecoins were created to mitigate volatility.

- Crypto is currently a subject of discussion worldwide, especially in relation to finance, innovation, and economics.

Why Cryptocurrency Matters Today

- Enables fast and low-cost global payments

- Encourages financial innovation Raises issues such as regulation and security, and stability from a financial point of view

Exam Relevance

- Important for Current Affairs, UPSC, SSC, Banking, State PSCs

- Topic links to Economy, Fintech, Digital Currency, Blockchain

Our Recent Blogs:

Gross NPAs of Banks Hit Record Low at 2.15% || Big Boost for the Indian Banking Sector

India Vs Pakistan Cricket Match Scheduled for February 15, 2026