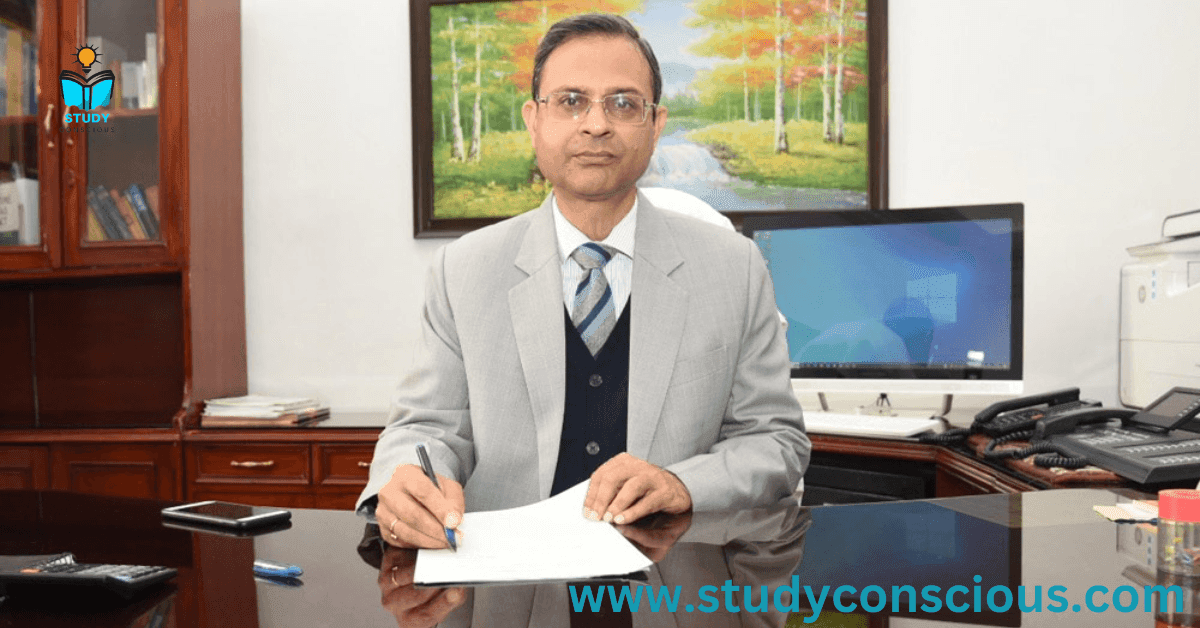

Sanjay Malhotra to be the new governor of RBI. He will take charge from 11th of December succeeding Shaktikanta Das the 25th governor of RBI. Sanjay Malhotra is an 1990 batch IAS officer from Rajasthan, currently serves as the revenue secretary in the Ministry of Finance. Malhotra has an expertise in a diverse domains like finance, taxation, banking and information technology.

Before his appointment as RBI Governor in December 2024, Malhotra served as the Revenue Secretary in the Ministry of Finance, where he played a key role in shaping India’s tax policies and driving revenue growth. He has also held positions such as the Secretary of the Department of Financial Services, where he was responsible for overseeing banking reforms and financial inclusion, and strengthening the public sector banking system.

About Shaktikanta Das

Shaktikanta Das is an influential Indian civil servant and economist, serving as the 25th Governor of the Reserve Bank of India (RBI) from December 2018 to December 2024. A retired 1980-batch IAS officer from the Tamil Nadu cadre, Das has held several important positions in India’s finance and economic sectors. Before his appointment as RBI Governor, Das served as the Secretary of the Department of Economic Affairs, where he played a key role in policy formation related to the Indian economy, including overseeing reforms and fiscal policies. He has also served as India’s Sherpa to the G20 and as a member of the 15th Finance Commission.

His tenure as RBI Governor was marked by his efforts to address critical challenges, such as tackling inflation, managing economic instability, and overseeing the banking sector’s recovery post-pandemic. Das was also reappointed for a second term in 2021 due to his leadership in navigating economic turbulence and implementing monetary policy effectively. His approach focused on ensuring financial stability, managing inflationary pressures, and supporting India’s economic recovery.

Roles and Responsibilities of RBI Governor

1. Monetary Policy Oversight

2. Regulating the Banking System

3. Currency Management

4. Foreign Exchange Management

5. Advising the Government

6. Overseeing Financial Inclusion

7. Financial Stability

8. Signature on Currency Notes

About RBI

The Reserve Bank of India (RBI) is India’s central banking institution, responsible for overseeing the country’s monetary policy, managing currency, regulating the banking system, and ensuring financial stability. Established in 1935 under the Reserve Bank of India Act, the RBI plays a critical role in India’s economic development.

Key Functions of the RBI:

- Monetary Policy: The RBI formulates and implements policies to control inflation, stabilize the currency, and support economic growth by managing interest rates and money supply.

- Currency Issuance: The RBI is the sole authority for issuing the Indian Rupee (INR) and managing the supply of currency in circulation.

- Bank Regulation: It regulates and supervises financial institutions and banks in India, ensuring their financial health and stability.

- Foreign Exchange Management: The RBI manages India’s foreign exchange reserves and ensures smooth functioning of the foreign exchange markets.

- Government’s Banker: It acts as the banker to the Government of India and helps in managing public debt, managing foreign exchange reserves, and facilitating payments.

Structure and Governance:

The RBI is headed by a Governor, currently Sanjay Malhotra (as of December 2024). The Governor is supported by four Deputy Governors and other staff members. The RBI’s autonomy allows it to make decisions without political interference, although it operates within the framework of government policies.

Historical Context:

Initially, the RBI was established as a private bank and was later nationalized in 1949. Over the decades, its role evolved significantly, especially in response to India’s economic challenges and global financial shifts. Notable RBI governors like Manmohan Singh, Raghuram Rajan, and Shaktikanta Das have shaped the country’s banking landscape through various reforms and policy decisions.

The RBI also plays a crucial role in driving financial inclusion, ensuring that banking services reach all segments of society, especially in rural and underserved areas.

For more detailed information on RBI’s functions and governance, you can visit official RBI resources or further research its historical developments.